Best site for buy crypto marks the beginning of your journey into the world of digital currencies, where finding the right platform can make all the difference in your investing experience. As the crypto space continues to evolve, choosing the most reliable site is not just about convenience but also about security, ease of use, and trust.

Online platforms for buying crypto have come a long way, offering a variety of services from classic exchanges to peer-to-peer options. When you decide to buy crypto, it’s important to compare key features like fees, supported coins, payment methods, and user verification processes. Regulation and security measures such as two-factor authentication and insurance play a big role in keeping your assets safe, while user experience and customer support can turn a potentially confusing process into a smooth one.

Overview of Online Crypto Purchasing Platforms

Online crypto purchasing platforms serve as digital gateways for users who want to buy, sell, or trade cryptocurrencies. These platforms have grown rapidly, adapting to broader adoption, increased regulations, and user demand for security and convenience. While their primary function remains facilitating crypto transactions, modern platforms also offer a suite of features, including wallet services, educational content, and advanced trading tools.

The first generation of cryptocurrency exchanges emerged in the early 2010s, starting with basic, peer-to-peer transactions. As Bitcoin and other digital assets gained mainstream traction, platforms evolved to include centralized exchanges with custodial services and more robust trading infrastructure. This shift was fueled by the need for greater reliability, liquidity, and adherence to evolving legal frameworks.

Regulation and security have become focal points in the world of online crypto marketplaces. Regulatory oversight varies by country but typically aims to curb illicit activity, safeguard user funds, and ensure fair trading practices. Security features—such as two-factor authentication, cold storage, and insurance—are now standard, as platforms strive to protect users from increasingly sophisticated cyber threats.

Modern crypto buying platforms can be grouped into several main types, each offering different user experiences and functionalities:

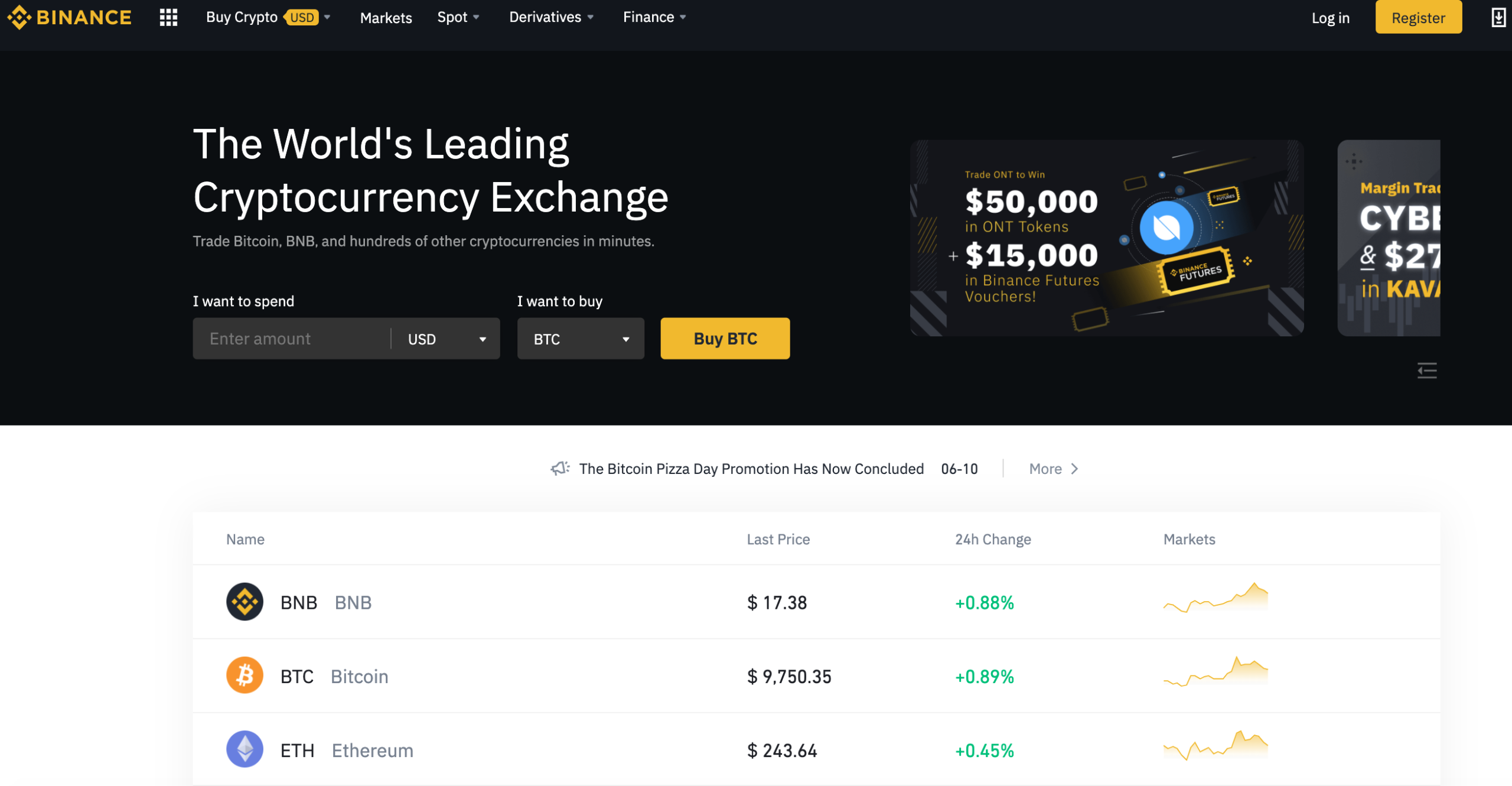

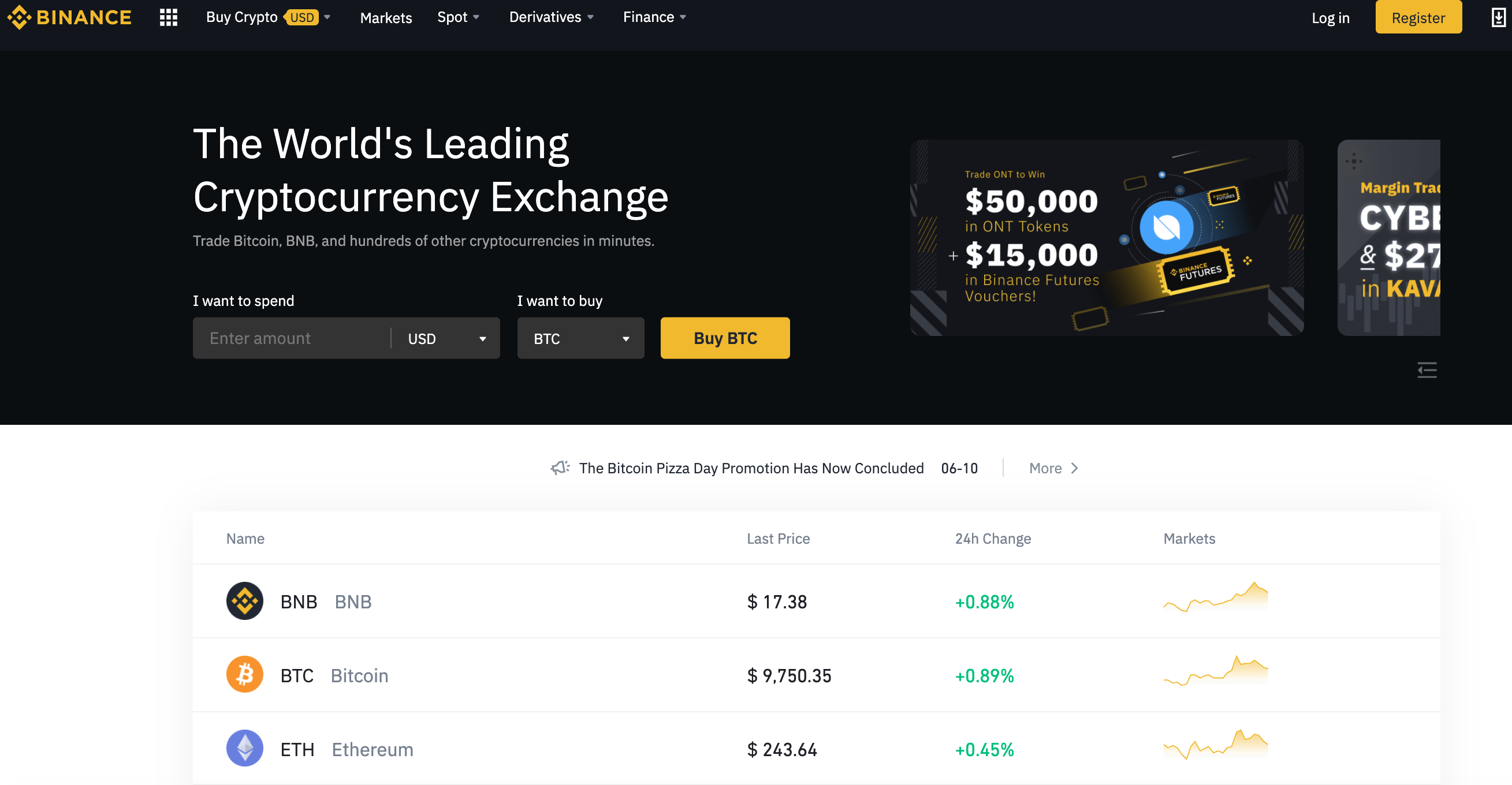

- Centralized Exchanges (CEX): These platforms act as intermediaries, holding users’ funds and providing liquidity for quick trades. Examples include Coinbase and Binance.

- Crypto Brokers: Brokers facilitate crypto purchases at set prices, often with simpler interfaces suitable for beginners.

- Peer-to-Peer (P2P) Marketplaces: These platforms connect buyers and sellers directly, offering more privacy and a broader range of payment methods.

- Decentralized Exchanges (DEX): DEXs operate without a central authority, allowing users to trade directly from their wallets without relinquishing control of funds.

Criteria for Selecting the Best Site to Buy Crypto

Selecting a crypto buying site involves evaluating several key factors that directly impact security, user experience, and overall value. The best platforms strike a balance between competitive fees, a broad selection of supported coins, robust security, and ease of use.

Essential Factors to Evaluate

When choosing a platform, it’s important to consider the following:

- Fees and Costs: Low fees are attractive, but sometimes higher fees come with better customer support or extra features.

- Supported Coins: Platforms differ in the range of cryptocurrencies available. Some specialize in popular coins like Bitcoin and Ethereum, while others offer hundreds of altcoins.

- Payment Methods: Common options include bank transfers, credit/debit cards, PayPal, and sometimes even cash or gift cards through P2P markets.

- Regulation and Security: Look for platforms with strong regulatory backing and clear safety protocols.

- User Experience: Intuitive interfaces and accessible platforms (mobile apps, web access) are crucial for a seamless process.

Comparison of Security Features and User Verification Processes

Strong security and thorough verification help prevent fraud and protect user assets. Here’s how top platforms compare on these fronts:

| Platform | Security Features | KYC Requirement | Insurance |

|---|---|---|---|

| Coinbase | 2FA, cold storage, bug bounty | Yes (mandatory) | FDIC-like for USD balances |

| Binance | 2FA, SAFU fund, withdrawal whitelist | Yes (tiered levels) | SAFU fund for emergencies |

| Kraken | 2FA, global settings lock, encryption | Yes | Comprehensive cold wallet insurance |

| Paxful | Escrow, 2FA, P2P dispute system | Yes (varies by region) | No |

Accessibility and User Experience

Accessibility features, such as high-quality mobile apps and responsive web interfaces, dramatically improve the buying process. Leading platforms invest in intuitive interfaces, clear navigation, and real-time notifications to keep users informed and engaged throughout their crypto journey.

Comparison of Popular Crypto Buying Sites

The crypto ecosystem offers a range of platforms, each with distinct strengths and trade-offs. Below is a comparison of leading sites, highlighting their supported coins, fee structures, and standout features.

| Name | Supported Coins | Fee Structure | Unique Feature |

|---|---|---|---|

| Coinbase | 100+ | Spread + variable fee | User-friendly interface for beginners |

| Binance | 350+ | Tiered maker/taker fees | Advanced trading tools |

| Kraken | 200+ | 0.16%-0.26% trading fees | Strong security record |

| Paxful | BTC, USDT, ETH | Seller pays 1% fee | Peer-to-peer, global payment options |

Pros and Cons of Leading Platforms

Each site offers a different balance of features and user experience.

- Coinbase: Extremely user-friendly and well-regulated, but fees may be higher compared to competitors.

- Binance: Offers a wide selection of coins and advanced trading options, though the interface can be overwhelming for beginners.

- Kraken: Renowned for security and professional support, but may have a steeper learning curve for new users.

- Paxful: Provides unmatched payment flexibility and privacy for P2P trades, but requires caution to avoid scams.

Suitability for Beginners and Advanced Users

Platforms like Coinbase are best for beginners seeking simplicity and regulatory reassurance. Binance and Kraken cater to advanced users looking for deep liquidity, trading tools, and lower fees. Paxful is suitable for privacy-conscious individuals and those needing unconventional payment methods, provided they take appropriate security precautions.

Step-by-Step Procedure for Purchasing Crypto Online

Although navigation and features differ, the process for buying crypto on most platforms follows a similar pattern. Understanding these steps helps ensure a smooth and secure transaction.

General Process for Buying Crypto

The standard process can be broken down as follows:

- Account Creation: Sign up with your email and set a secure password.

- Verification: Complete identity verification (KYC) by providing personal information and documentation.

- Depositing Funds: Add funds to your account using bank transfer, credit/debit card, or supported payment methods.

- Placing an Order: Choose the crypto and amount you wish to purchase, review order details, and confirm the transaction.

- Storage: Move your newly purchased crypto to a secure wallet, either within the platform or to an external wallet for added security.

Alternative Purchasing Methods

Besides the standard flow, users can choose from several alternative purchasing methods, each offering unique advantages:

- Credit/Debit Card: Fast and convenient, but can incur higher fees and may have purchase limits.

- P2P Trading: Enables direct transactions between users for more privacy and flexible payment choices, with escrow protection on reputable platforms.

- Bank Transfer: Often allows for higher limits and lower fees, but can take longer to process.

Many platforms support instant swaps, crypto ATM integration, or even third-party payment providers, allowing users to tailor the purchasing process to their needs.

User Experience and Customer Support

A seamless user experience and effective customer support can be the difference between frustration and satisfaction when buying crypto. Top platforms invest in user-focused design and multiple assistance channels to resolve issues swiftly.

Value of Responsive Customer Support

Responsive customer support ensures users receive real-time help with problems like delayed transactions, security concerns, or account lockouts. Channels include live chat, 24/7 email support, and detailed help centers with FAQs and guides.

Common User Issues and Resolutions

New users often struggle with account verification, forgotten passwords, or unclear transaction statuses. Leading sites streamline the onboarding process, automate verification, and provide troubleshooting wizards. For example, Coinbase’s automated KYC checks and Binance’s step-by-step wallet recovery guides reduce wait times and user frustration.

Community Forums and Educational Resources

Active community forums and robust educational resources empower users to find answers and share knowledge. Many platforms offer in-depth learning hubs, video tutorials, and discussion boards, fostering a sense of community and ongoing engagement.

Security Risks and How to Stay Protected

The online crypto landscape is susceptible to several security threats, but users can mitigate risks with vigilance and good practices. Awareness and proactive defense are key to safe crypto buying.

Common Security Threats

Phishing attacks, hacking incidents, and scams are prevalent in the crypto space. Attackers may mimic legitimate sites, exploit weak passwords, or lure users into revealing sensitive information. Even reputable platforms can be targeted, so personal security measures are vital.

Recommended Safety Practices

Staying protected requires a layered approach, including secure account management and ongoing vigilance.

- Enable two-factor authentication (2FA) for all accounts.

- Create strong, unique passwords and update them regularly.

- Use withdrawal address whitelisting to limit unauthorized transfers.

- Monitor account activity for unusual logins or transactions.

- Avoid sharing sensitive information through unofficial channels.

- Double-check URLs and only access platforms through official websites or apps.

Regulatory Considerations and Legal Compliance

Regulatory requirements for crypto sites differ widely across jurisdictions. Legal compliance shapes what platforms can offer and affects user onboarding, privacy, and taxation.

Global Regulatory Status and KYC Requirements, Best site for buy crypto

Countries adopt varying stances on crypto, from strict licensing to outright bans. Most major platforms comply with international anti-money laundering (AML) standards and require Know Your Customer (KYC) procedures before trading.

| Country | Regulation Status | KYC Requirement | Licensed Platforms |

|---|---|---|---|

| USA | Highly regulated | Mandatory | Coinbase, Kraken |

| UK | Regulated, strict FCA oversight | Mandatory | Gemini, eToro |

| Japan | Licensed exchanges only | Mandatory | bitFlyer, Coincheck |

| India | Unregulated, evolving policies | Varies | WazirX, CoinDCX |

Taxation and Privacy Implications

Users should be aware that buying crypto often carries tax obligations. Most countries require reporting of capital gains from crypto trading. Privacy-minded users must balance compliance with the need for anonymity, as KYC processes store personal data with platforms.

Illustrative Use Cases: User Profiles and Site Recommendations

The best crypto buying site depends greatly on individual goals, experience, and preferences. Here are some example user profiles and tailored recommendations:

Beginner: New to crypto, values simplicity and clear instructions.

- Recommended Platform: Coinbase

- Reasoning: The interface is highly intuitive, with step-by-step guides and strong customer support. Fees are transparent, and security is robust, making it ideal for learning the basics without being overwhelmed.

- Tip: Start with small purchases and explore educational resources before committing larger amounts.

Investor: Seeking long-term exposure to top cryptocurrencies.

- Recommended Platform: Kraken or Binance

- Reasoning: Both platforms provide a wide range of coins, competitive fees, and advanced security features. Staking and savings products are available for passive income.

- Tip: Consider using cold storage for large holdings and review platform insurance policies.

Active Trader: Interested in trading frequently and using advanced tools.

- Recommended Platform: Binance

- Reasoning: Binance offers high liquidity, advanced charting, margin trading, and robust APIs for frequent traders.

- Tip: Set up trading bots with caution and utilize stop-loss features to manage risk.

Privacy-Focused User: Prioritizes anonymity and alternative payment options.

- Recommended Platform: Paxful or other reputable P2P marketplaces

- Reasoning: P2P platforms offer flexible payment methods and the ability to trade without sharing extensive personal information, depending on local regulations.

- Tip: Always use escrow features and verify the reputation of trading partners to avoid scams.

Conclusion: Best Site For Buy Crypto

Choosing the best site for buy crypto ultimately depends on your needs and preferences. With so many options available, understanding the differences between platforms and what they offer helps you make informed decisions. Whether you’re a beginner, an investor, or a privacy enthusiast, the right site can provide a secure, convenient, and rewarding crypto buying experience.

Query Resolution

What makes a site the best for buying crypto?

The best site offers strong security, a wide selection of coins, low fees, user-friendly design, and reliable customer support.

Can I buy crypto with a credit card?

Yes, many platforms allow you to buy crypto with credit cards, though fees may be higher compared to other methods.

Is identity verification always required?

Most reputable sites require identity verification (KYC) for security and regulatory compliance, but some peer-to-peer platforms may offer limited services without it.

How do I keep my crypto safe after buying?

Transfer your coins to a secure wallet, enable two-factor authentication, use strong passwords, and whitelist withdrawal addresses when possible.

Are there hidden fees when buying crypto online?

Some platforms charge additional fees for deposits, withdrawals, or certain payment methods, so always review the fee structure before buying.